Archive for the ‘Saving’ Category

Frugality Tips

Written by Sam on April 12, 2010 – 12:20 pm -I recently received a request to answer a few questions about frugality. The request came from CESI Debt Solutions who had posted quotes from 19 other personal finance bloggers that you can read here. That article was then picked up by Time magazine and as a follow up CESI Debt Solutions wanted to publish even more tips from more bloggers.

So here’s my little contribution.

Question #1 – What’s your “frugality story?” In other words, how and why did you become frugal?

My wife and I had recently moved into a house, adopted a child, had a number of surgeries, and transitioned from two incomes to one, all within a year. We were forced to get control over our finances quickly or have a major lifestyle adjustment (like moving out of our house). We had a strong incentive and knew we could survive by taking control of our finances. As a result, we worked our way through it and created our own system that has allowed us not only to survive but to reach our financial goals with increased speed and focus.

Question #2 – What, if anything, tempts you to overspend, and how do you resist?

I’m always shifting from one hobby to the next so there’s always an excuse to spend. My two biggest weaknesses right now are books and board games.

One general technique I use is to imagine what will happen after the purchase is made and I’m at home. For example, if I buy the book, will I read it when I get home or will it go into my pile of unread books on the bookshelf? Just getting that picture in my mind helps clarify if I REALLY want it and will use it or if I’m just in the moment and getting sucked into a purchase I won’t get any real enjoyment from. This trick works particularly well with board games since they’re social. Sometimes I almost get sucked into buying a game that I know my friends and family won’t be interested and will never get played. Projecting into the future helps me make a good decision.

Another trick I use is to see if I can rent or borrow the item. With books, you can borrow them from a library. With board games, you can often find a friend that has the game you can borrow. My local game store even has rental games you can check out for 10 days and the rental price goes towards a purchase when you return it. I’ve often taken that option and find after playing the game that I don’t really care to own it.

One interesting side note is that I bought a Kindle last year and have made no physical book purchases since then. In fact my overall book purchases have gone WAY down. I attribute this to the fact that I can get any book I want instantly through my Kindle. This eliminates the psychological response of wanting to get a book just to have it when I need it or because I’m afraid it won’t be there later when I want it. I only purchase the books I’m ready to read NOW which is a much smaller number than the books I WANT to read. It has probably saved me a couple hundred dollars in book purchases.

Question #3 – What personal finance or frugality habits were the hardest for you to adopt and why?

Using cash was probably the hardest because credit cards are so convenient. But whatever inconvenience you suffer on the front-end making purchases is more than made up for on the back-end when reconciling your transactions. One cash withdraw entry vs. 40+ miscellaneous purchases and entries.

Cash has also been the single biggest thing that has helped us to control our spending. It’s an instant, compelling feedback mechanism. It makes you feel a much stronger connection to the money you spend versus credit cards which make you feel disconnected and therefore make you more likely to overspend.

Question #4 – Have you ever taken frugality too far? How so?

You know, I don’t think I ever have. I tend to always push the limits of spending more than I should. My wife used to do things like rinsing out ziploc bags to use them later, but I convinced her it’s an unnecessary if not unsanitary habit.

Question #5 – What resources (blogs, books, websites) would you recommend to someone who’s newly frugal?

- Anything by Dave Ramsey but, in particular, his Financial Peace University program

- The Richest Man in Bablyon

- The Millionaire Next Door

- Rich On Any Income

- My 12 Weeks to Fiscal Fitness program, of course

Posted in Saving, Uncategorized | 2 Comments »

Get Free Books From PaperBackSwap.com

Written by Sam on August 28, 2009 – 11:08 am -

I recently learned about the site PaperBackSwap.com that allows you to swap books with others via mail. They have a nice system with some checks and balances that facilitate trust and honesty between traders. The site works on a credit system. When you sign up, if you immediately list 10 books you’re willing to trade, they give you 2 credits. Each credit allows you to receive one book. Audio books can also be traded and require 2 credits to receive. Every time you send a book you get a credit. You’re basically trading a book for a book.

How does the shipping part work? Once someone requests one of your books you have two options. The first option is to go to the post office and send the book. Once the person receives the book, they login to the site and mark it as received and you get your credit. The second option is to use PaperBackSwap’s built in system to pay for the postage and print out the needed labels at home. Using this system allows you to avoid a trip to the post office since you can just drop the book in your mailbox. Using this system also gives you your credit immediately so you don’t have to wait for the person receiving the book to mark it as received to get your credit. There’s a small additional fee to use this service, but it’s typically less than a dollar and probably cheaper than paying for the gas to go to the post office.

So far I’ve sent three books and have yet to request any. The selection of books posted looks decent, but not overly comprehensive. I found a few books I was interested in. If a book you want isn’t listed as available, you can reserve a copy and once someone has one available, you’ll be notified. The jury is still out for me on this site. I’ve spent an average of about $3.00 per book for each book I’ve sent. That’s less that half the price of buying a book new so if I end up getting some books I want through the service, I’ll consider it a success. If nothing else, it’s good to get rid of some books I no longer needs and reduce my clutter.

PaperBackSwap also has two sister sites; one for trading CDs and one for trading DVDs. I haven’t looked at them closely yet, but assume they work on the same system. If you want to refresh your collections, take a look.

Have any readers used these services? Let us know how you liked them in the comments.

Tags: books, Saving, Shopping

Posted in Saving, Shopping | Comments Off on Get Free Books From PaperBackSwap.com

Affordable Hobbies: An Introduction to Geocaching

Written by Sam on August 11, 2009 – 8:30 am - Given the tight economy it’s more important than ever to keep control over your finances. In our family, we’ve had to cut back on entertainment expenses. Now instead of paying a babysitter, we trade off babysitting with a neighbor. We’ve stopped eating out very much, and try to eat at home. It’s been a while since we’ve been to the movie theater and usually opt to rent a $1 Red Box movie instead.

Given the tight economy it’s more important than ever to keep control over your finances. In our family, we’ve had to cut back on entertainment expenses. Now instead of paying a babysitter, we trade off babysitting with a neighbor. We’ve stopped eating out very much, and try to eat at home. It’s been a while since we’ve been to the movie theater and usually opt to rent a $1 Red Box movie instead.

Cutting back has also affected how we spend money on our hobbies. Ok, I’ll be truthful; it’s cut back on how much I spend on hobbies. For example, I used to fly remote-control airplanes which is not a cheap hobby. With each outing I ended up spending $20-40 on parts after the plane crashed. To get started alone can run from $150 to upwards of $1,000. Needless to say I haven’t flown lately.

Instead, I’ve found myself spending time on hobbies that are much more affordable. One such hobby is Geocaching.

What is Geocaching?

Pronounced jee-oh-kashing, Geocaching is like a modern-day treasure hunt. Someone hides a container, known as a “cache” (pronounced “cash”), anywhere in the world and then records the location using a GPS (Global Positioning Satellite) unit. He then logs in to the website Geocaching.com and uploads the coordinates. He can add a description of the cache and location or even add a theme or a quiz to the cache to make it more interesting.

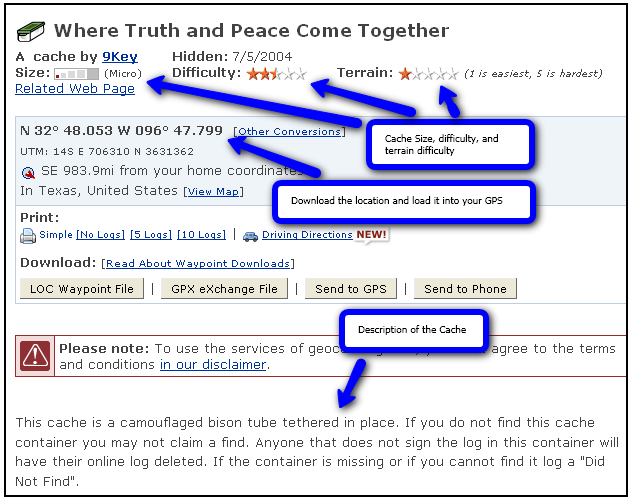

Here’s an example of what a typical cache might look like on geocaching.com:

Once the cache is placed and the coordinates are uploaded, anyone can go to the geocaching.com website and search for caches they can find in their geographic area.

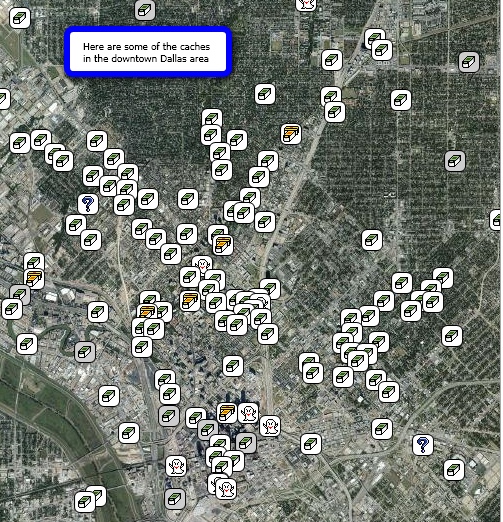

Below is a screenshot of caches found in the downtown Dallas TX area:

Once you identify the caches you want to find, you can load the coordinates and description of the cache into your GPS unit or gps-enabled phone and set off on an adventure to find the cache.

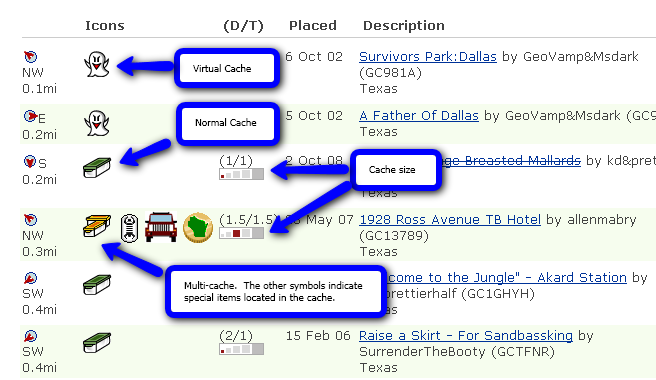

The image below shows the results of a search for caches in the Dallas Texas area:

Once you find the cache you write your name in a log book located in the cache itself. If the cache container is large enough, there are typically a few trinkets placed inside as well. Geocaching etiquette dictates that you can take something from the cache as long as you leave something. It’s great for kids because it’s literally a modern-day treasure hunt. You never know what you’re going to find. When you get home after finding the cache you can then login to geocaching.com and record your find, thereby keeping track of your exploits. I personally have logged over 50 entries and I’m a novice. The more active participants have logged hundreds of finds.

Where can you participate in geocaching?

Although geocaching is still relatively obscure, I’ve been amazed at how many caches there are. Go ahead and test it yourself right now by entering your zip code at Geocaching.com and see how many results appear. Once the results appear, click on the “map it” link in the upper right hand side of the screen to see a map view of the caches. I’d bet that there are several caches within a couple miles of your home. In fact, there are possibly tens or hundreds within your city boundaries.

While populated areas often have hundreds of caches, it’s also common to find them in the wilderness. In fact, this is where more of the large-sized caches are found. Many people use geocaching as an excuse to exercise and get out in nature.

What types of caches are there? What are they like?

The cache containers range from extremely small (the size of a thimble or even smaller) to very large (the largest I’ve seen was an average-sized cooler). It’s common to see containers in the form of Altoids tins, small medicine bottles, ammo boxes, and Tupperware containers. Really small caches are known as “micro-caches” and can be located in even the most crowded urban areas without being noticed.

The image below-left shows an ammo box cache. Below right shows a tupperware cache:

There are also caches known as “virtual” caches where there’s no physical container. Instead you have to locate a landmark of some sort. It’s common for virtual caches to lead you to a historical marker or location.

My favorite caches are “multi-caches” which consist of a series of caches that each give you a clue leading to the final cache. It’s like trying to solve a mystery or puzzle and can take several outings.

Who typically participates in geocaching?

There’s a pretty broad range of people who geocache including scouting groups, retirees who find it a good form of exercise, and families. I had a business colleague who would take his GPS unit on business trips and use geocaching as a way to familiarize himself with the area and its history. During one business meeting, the client was impressed with his knowledge of the area.

How much does it cost to get started?

The great thing is that you can get started geocaching for relatively cheap if not free. Many new smart phones have GPS functionality built in along with programs to map your position. In this case, no purchase is necessary. Otherwise, you’ll have to purchase a GPS unit. GPS units range in cost from around $50 to several hundred dollars. Last week I saw a very good GPS unit with mapping capabilities on sale for $100. While even the cheapest units will work, I recommend getting a unit with mapping capabilities. All but some of the cheapest units have maps built in.

Once you have a GPS-enabled unit, you can go to geocaching.com and start searching for caches and logging your finds for free. Geocaching.com offers a subscription service for $30 a year or $10 a quarter that allows some advanced features such downloading multiple caches at once and sending automatic emails containing new caches in your area. I currently subscribe to the service and find it very useful.

There is also software you can download to some smart phones that integrates with geocaching.com to instantly show nearby caches and with the built-in GPS functionality to show you the way. I used a trial version of the software on my Blackberry and found it very useful for impromptu caches when I felt the itch or had some spare time while traveling. On my particular phone I didn’t find the GPS to be quite as accurate as my stand alone unit, but the convenience made up for weaker accuracy. For some caches, I also found myself getting a little dirty and didn’t want to expose my phone to the elements. In such cases a stand-alone GPS unit may be better since they’re rugged and typically water-resistant. I recently checked out the geocaching website and saw that they have a new iPhone app. I must admit I was drooling over the satellite map integration and large interface. It looks like a very worthy iPhone application.

Making memories

One of the best things about Geocaching is building memories with others. I have vivid memories of the adventures I’ve been on while Geocaching with others. I’ve been with my son, friends, in-laws, and cousins. One particularly tricky multi-cache adventure took me and my brother-in-law from one side of Las Vegas to another. We probably covered 150 miles in one night. By the time we got to the last cache it was dark and we were in the middle of the desert trying to find the cache by flashlight. After about a 40 minute search, we finally found it. Good times.

If you’ve tried Geocaching, leave a comment and tell us a story from your own adventures.

Posted in Entertainment, Hobbies, Saving | 3 Comments »

8 products that save you money, save the environment, and make life easier.

Written by Sam on October 3, 2007 – 7:52 pm -

I’m constantly on the look out for products that will make life easier and save money. The following list of products not only makes life easier and can save you money, but they can also help the environment. I remember seeing a Wal-Mart video that mentions if everyone bought and used one energy-saving light bulb, there would be a huge reduction in energy use. One small change if made by enough people can make a huge difference.

I’m constantly on the look out for products that will make life easier and save money. The following list of products not only makes life easier and can save you money, but they can also help the environment. I remember seeing a Wal-Mart video that mentions if everyone bought and used one energy-saving light bulb, there would be a huge reduction in energy use. One small change if made by enough people can make a huge difference.

1. Motion Activated Wall switch. I’m a big fan of motion activated sensors. I use them anyplace that we use light in short bursts and then forget to turn them off; in our garage; in our pantry; in our walk-in closet. I’ve been tempted to put them in the bathroom but it’s harder to gauge how long to set the shut-off timer. I’m so used to walking into these places and just having the lights turn on automatically that when I go to someone else’s house I think there’s something wrong when the light doesn’t turn on. You can set the lights to go on anywhere from a few seconds to several hours, depending on the switch. I don’t necessarily have a favorite brand. As far as I know, they all perform about the same. If anyone’s had a particularly good or bad experience with a brand or model, please leave your thoughts in the comments.

- Cooper Wiring Devices motion sensor wall switch – This is the one I use.

- Here are some other brands of motion sensor wall switches.

- There is also a version made by First Alert you can plug directly into a light bulb socket that would be great for a garage or basement.

2. Motion Activated Electrical Outlet. I’ve never used one of these but, as you know, I’m a big fan of motion sensors. I would use this for lamps, fans, heaters, radios, or even power strips connected to electronics.

3. Motion-activated flood lights. Yes, another motion-activated product. We use these around the outside of our house; one on each side and two sets in the back. Not only are they great for conserving energy, they are also incredibly effective for burglary prevention. You couldn’t break into our house on any side without being in the spotlight.

4. Kill A Watt energy tracker. This device shows you how much energy other electronic devices use in kilowatt-hours. It can also monitor voltage, line frequency and power factors. I’m a little nervous getting one of these because I would spend too much time testing all our appliances. But that’s a good thing, right? By finding energy-guzzling appliances you can be more aware to use them conservatively or turn them off when not in use. A couple of common energy leaks are leaving electronics plugged in even when they’re not in use and leaving your computer turned on at night.

- Here is the “Kill A Watt” brand monitor.

- Here are monitors from several brands.

5. Renu-it battery charger. I go through a lot of batteries. My three-year-old boy loves trucks that make noises and take 4 C batteries. Add to that my extensive use of portable electronics and I go through batteries like crazy – AAs, AAAs, and Cs, you name it. I’ve used rechargeable batteries before but the cost of them is high and they wear out over time. The other problem is that batteries tend to disappear around my house and I don’t want expensive rechargeable batteries walking off.

Enter the Renu-it battery charger. It charges regular alkaline, titanium, and rechargeable batteries safely. It has built-in mechanisms to prevent overcharging, overheating, and short-circuits. I’ve never used this product but I love the idea. This is definitely on my shopping list.

6. Valve cap pressure indicators. Not all the products on this list are for electronic devices. These clever units replace the existing valve caps on your car tires and constantly show the tire’s pressure making it easy to know when to add a little air. According to the EPA, you can improve your car’s gas mileage by more than 3 percent simply by keeping its tires inflated to the proper pressure. In addition, keeping tires inflated properly can extend the life of your tires so you’re saving money in more than one way. Keeping your tires properly inflated is also safer since under-inflated tires are less responsive, particularly in the rain and snow. One word of warning: a few Amazon reviews indicated that some defective valve caps may cause the tires to leak slowly.

- Analog Tire Pressure Valve Caps.

- Electronic tire pressure valve caps that blink when your tires are low.

7. MagLite LED bulb-replacement kits. It’s now common knowledge that LED lights use a small portion of the energy of regular incandescent lights and last way longer. LED lights are increasingly common in flashlights, electronics, and are even available as replacements for household light bulbs. These clever kits allow you to replace the bulb in a Maglite flashlight with an LED or luxeon light bulb. Most people I know have a number of old Maglites lying around. Now they can be updated and brought into the 21st century at about half the price of a new Maglite.

- Conversion kit for AA Mini Maglites.

- Conversion kit for C and D cell Maglites.

- Conversion kit for 3C and 3D Maglites

8. Energy-saving light bulbs (LED or florescent). According to one Fast Company article compact fluorescent light bulbs emit the same light as classic incandescents but use 75% or 80% less electricity. Florescent bulbs are now commonly sold at major retailers. Another benefit is that the bulbs are supposed to last much longer, even for several years. Over the lifetime of the bulb you will easily save more money than you paid for the bulb.

We use florescent bulbs in several places in our house. I must admit I don’t like the light they produce as much as incandescent bulbs, but the right color lamp shade can remedy that for the most part. Less common (and much more expensive) are LED household light bulbs. There are currently LED bulbs available on the market but they are still too high priced for most consumers. I’m anxious to see what kind of light LED bulbs produce in a household light.

- Here are a variety of fluorescent blubs including regular sized bulbs and floodlights.

- Here are a couple of LED lights including a small version and a floodlight version. They didn’t get very good reviews and are quite expensive. It looks like LED technology isn’t quite ready to invade household lighting.

- This is an excellent Fast Company article outlining the benefits of CFL bulbs and how Wal-Mart has led a campaign to get consumers to start converting to CFLs. Well worth a read.

Do you know of any other energy-saving or money-saving products? Leave them in the comments below!

Posted in Saving, Shopping | 17 Comments »

Financial Peace University Overview Part 3 – Retirement and College Planning

Written by Sam on August 9, 2007 – 1:16 am - Part 3 of the FPU overview covers week 8 of Financial Peace University – Retirement and College Planning. This post will apply to Dave Ramsey’s baby steps #4 and 5. Baby step #4 is: Invest 15% of your income into tax-favored investments (typically Roth IRAs or 401ks). Baby step #5 is : College funding. It is assumed that you won’t start doing either of these steps until you have saved a full emergency fund (3-6 months of expenses) and paid off all your debt except your house.

Part 3 of the FPU overview covers week 8 of Financial Peace University – Retirement and College Planning. This post will apply to Dave Ramsey’s baby steps #4 and 5. Baby step #4 is: Invest 15% of your income into tax-favored investments (typically Roth IRAs or 401ks). Baby step #5 is : College funding. It is assumed that you won’t start doing either of these steps until you have saved a full emergency fund (3-6 months of expenses) and paid off all your debt except your house.

If you’re joining this series late and want to catch up see the links below for parts 1 and 2:

FPU Overview Part 1

FPU Overview Part 2

Why should I have an emergency fund and no debt before investing for retirement and college?

Dave is very strict about having an emergency fund and paying off debt before investing for retirement. He even says you shouldn’t put money in a 401K with a match (which is when your company matches a portion of what you invest – it’s basically free money). When we attended Financial Peace University we were already contributing to a 401K with a match and decided not to follow his advice on this point. It would have been much more disruptive to stop contributing. We would have lost the match and had to wait until the enrollment period to start up again.

Saving an emergency fund before saving for retirement

I’m aware that many people disagree with Dave’s advice on this point because if you wait to invest, you lose some of the advantages of compound growth. I personally can see it both ways. I tend to agree that you should have an emergency fund first. Otherwise you may have to dip into your retirement savings to cover emergencies and invoke severe tax penalties. If you take funds out of a 401K or IRA before retirement you pay excessively high taxes which would be like kicking you when you’re already down.

Paying off debt before saving for retirement

Having all your debt paid off before saving for retirement is a more tricky argument. Frankly, Dave doesn’t address it much. As far as I can tell, the main reason for doing so is focus. The more you focus ALL available money on paying off debt the more momentum you’ll get. There’s a strong psychological benefit to seeing your debt paid off at an accelerated rate.

From a math perspective, you can argue either way. If the interest rate on your debt is higher than the interest rate you’d get investing (typically about 10-12% if you invest in mutual funds), you’re better off paying down your debt. Otherwise, you’re better off investing. Having said that, even if you think you could earn 10-12% on a mutual fund, you’re not necessarily guaranteed that rate of return whereas you are guaranteed the return by paying off your debt.

In the end, I don’t think it matters much whether you pay off debt first before investing or not. I would do whichever gives you the most motivation and peace.

What investment vehicles should I use to invest for retirement?

During the session, Dave explains many savings vehicles in great detail including IRAs, Roth IRAs, SEPs, 403Bs, 457s, and 401Ks. Rather than explain them all, I’ll hit the highlights. Here is Dave’s basic strategy for investing for retirement:

- If your company’s 401K offers a match, invest just enough to take advantage of the full match.

- Next invest in Roth IRAs until you reach your maximum contribution.

- If you still have money left to invest, go back and invest in company plans (401Ks) or SEPs.

Within IRAs, Roth IRAs and 401Ks, you can choose what stocks, bonds, and mutual funds you want to invest in. For Dave’s advice on how to allocate funds see Financial Peace University Summary Part 1

Now let’s briefly explain the differnt retirement vehicles. Keep in mind that these are the most basic definitions. I’ve included links with more information for those interested.

Types of retirement investment vehicles

IRA

IRA stands for Individual Retirement Account (or Arrangement). An IRA allows you to invest money pre-tax and allows your investment to grow tax free. You then only pay taxes when you withdraw the money at retirement. The IRA itself is really a stock, bond, mutual fund, or other investment that is simply designated as an “IRA.” Even real estate can be used for an IRA. As Dave puts it, the IRA is just a “coat” to keep your investment protected from taxes.

To invest in an IRA you have to have a earned income in that year. In 2007 you can invest up to $4,000 per person if you’re 49 or younger or $5,000 if you’re 50 or older.

Roth IRA

A Roth IRA is similar to a regular IRA with one huge difference – with a Roth IRA you invest money post-tax but then your investment grows tax free and you can withdraw it at retirement tax free. In very basic terms, you would typically choose a Roth IRA if you think your income at retirement will exceed your current income. Otherwise, a traditional IRA would make more sense.

Wikipedia entry about Roth IRAs

401K

A 401K acts like an IRA in that you invest money pre-tax and your savings grows tax free. You are then taxed when you withdraw the funds. One of the main differences between an IRA and 401K is simply that a 401K is offered specifically through your employer.

With a 401K you are also more limited in your investment options. The company running your 401K usually provides a pre-selected set mutual funds to choose from.

One benefit of 401Ks is that some employers offer a match – they will match a portion of the amount you save. For example, my current employer matches 100% of my contribution up to 4% of my income and then 50% of my contribution from 4 to 6% of my income. Just to make the math simple, if I made $100,000 and saved 6% of my income, rather than ending up with $6,000 invested I’d end up with $11,000 ($6,000 contribution plus a $5,000 match). It’s basically free money and you should definitely take advantage of a matching program if your employer offers one.

Dave points out some people don’t use the 401K if there is not a match. That’s a mistake. Even though they don’t offer a match you still get the great tax benefits and should still contribute.

The maximum contribution to a 401K for 2007 is $15,500.

403B

A 403B is essentially the same as a 401K but is offered by hospitals, schools, and non-profit organizations rather than corporations.

SEP

Simplified Employee Pension (SEP) plans provide a way for small business owners to provide retirement plans to themselves and their employees. When an employee participates in an SEP, they essentially create an IRA, which in this case is known as an SEP-IRA. SEP-IRAs have the same tax implications as traditional IRAs. Employees can contribute up to 25% of their income. Self employed individuals can contribute up to 18.6% of their net profit.

457

The 457 allows you to defer your compensation. Instead of receiving income now and being taxed on it now, you can receive it and be taxed on it later. Rather than receiving the income, you can invest it. Essentially this acts similarly to a 401K. I’m personally not familiar with 457s and Dave didn’t recommend them. Use your company’s 401K instead.

Standard Thrift Plan for government employees

For federal government employees you have the standard thrift plan. Dave recommends putting 40% in C fund (common stock plan, 17% return over 10 years. Modeled after S&P index), 40% in S fund (small company fund [aggressive growth], modeled after Barclays index, averaged 14% return over 10 years), and 20% in I fund (International, 8-9% return, modeled after the Barclays EAFE index).

Rolling out funds

401Ks, 403Bs, and 457s are all offered by your employer. The good news is, you can transfer or “roll out” these investments when you leave the company. You can also roll over IRA accounts. Dave recommends rolling out funds whenever you have the option because you have more flexibility in a non-employer plan – you can invest the funds exactly how you want rather than being forced to choose from a limited selection. 401Ks and IRAs can typically only be rolled when you leave the company. However, 403Bs can be rolled at any time.

When you roll funds, be sure to do a direct transfer rather than bringing the money home first. If you have them cut you a check they have to hold 20% of the money until you decide where to invest it. Then if you don’t reinvest you have taxes of about 40% on those funds.

When you roll out funds, you need to decide if you want to roll them to an IRA or Roth IRA. Dave recommends you roll them to an IRA unless you meet the criteria below, in which case you should roll them to a Roth IRA:

1. You will have saved $700,000 by the age of 65.

2. You can pay your taxes separately out-of-pocket. For example, if you roll $10,000 to a Roth IRA, you have to pay taxes on the $10,000 immediately. If you don’t have the funds to pay the taxes right now, you can roll funds in chunks as you have money to pay the taxes.

3. You have less than $100,000 in income the year of the roll. Rules state that you can’t roll to a Roth IRA if you have $100,000 or more in income that year.

Borrowing against 401K – DON’T DO IT!

Some people ask about borrowing money against your 401K. On the surface it seems like a good idea – you can pay yourself interest rather than the bank. However, you should never borrow against your 401K because there are severe risks. Here are 3 reasons why you shouldn’t borrow against your 401K.

- You unplug yourself from the stock-like returns.

- You might leave or be fired. If you leave, that loan is due in full within 60 days or it’s considered an early withdraw.

- If you die, you are deemed to have left the company and your spouse has to pay back the loan.

Saving for Education

For the seemingly rare few who already have a full emergency fund, all debt paid off, and are saving 15% of your income for retirement, you can move on to baby step #5: Funding your child’s college education. I think this step is appropriately placed in relation to the other goals. You need to make sure you take care of your own financial situation, including retirement, before worrying about your kids’ educations. If you don’t, they will have to take care of you financially when you retire. Of course, I paid for almost all my college education and therefore am biased towards having children pay their own way and/or get scholarships. Regardless of your stance, Dave’s placement of this baby step is prudent and appropriate.

Use ESAs and UTMA/UGMAs to save for your child’s education

Dave’s advice is pretty straight forward – save for your child’s education first using an ESA, then using an UTMA/UGMA if you max out the ESA.

Education Savings Accounts (ESA)

An ESA is essentially an IRA for education rather than retirement.

A parent sets up an ESA for his/her child and acts as the custodian. Contributions to an ESA grow tax-exempt. If the child uses the funds for qualified educational expenses, those distributions can be used tax free. You can make a maximum of $2,000 in contributions each year. You have have an income under $110,000 if filing as a single or $220,000 for married couples to use an ESA.

Investopedia has a nice overview of ESAs

Uniform Transfer to Minors Act (UTMA/UGMA)

If you max out your ESA contributions or you make too much money to contribute to an ESA you can use an UTMA. The Uniform Transfer to Minors Act allows you to open a Mutual Fund account in the name of the child. The parent is custodian of the account until the child is 18. The downside (or upside if you’re the child) is that funds in an UTMA don’t have to be used for education. The child can use funds how they want when they turn 21.

Don’t use 529 plans or use life insurance for college savings

Dave recommends staying away from 529 plans which force you to put the money into pre-defined mutual funds that don’t provide a good enough return. Age-based 529 plans invest the funds more conservatively as the child reaches 18 and give you no control. They are too conservative.

Dave also recommends avoiding the following:

- Using life insurance policies (such as the Gerber Life Insurance policy) to save for college

- Use savings bonds or zero-coupon bonds for college investing

- Using pre-paid college tuition

Conclusion

Please recognize that the above descriptions are not meant to be comprehensive by any means. Dave Ramsey goes into quite a bit more detail in Financial Peace University and even his descriptions are not comprehensive. Hopefully this will give you a base line for understanding your investment options and spur you on to learn more. Stay tuned for part 4.

Other Resources

Retirement Savings or Debt Reduction: Which is the Top Priority? [Get Rich Slowly]

Retirement Savings Or Debt Repayment: Which Is More Important? [The Simple Dollar]

3 Common 401(k) Mistakes [The Consumerist]

Posted in Dave Ramsey, Education, Investing, Retirement, Saving | 5 Comments »

Subscribe via email

Subscribe via email  Become a fan

Become a fan Subscribe via RSS

Subscribe via RSS Follow me

Follow me