Archive for August, 2009

Cash for Refrigerators

Written by Sam on August 24, 2009 – 9:20 am -Business Week (via Yahoo!) reported today on the government’s rebate program for new energy-efficient appliances. Similar to the “Cash for Clunkers,” the program will give rebates of $50 to $200 on new appliances. It was unclear to me what types of appliances will be covered, but it sounds like at least refrigerators and washing machines will be covered. There was no real specific information about the program since individual states will be determining the exact parameters.

I’ve been trying to get my head around these government programs and the affect they’ll have. I honestly hate the idea of the government encouraging and funding consumer purchases. What’s wrong with people making due with what they have? I assume that a large portion of the people participating in these programs will make their new car and dish washer purchases using debt, thus further increasing overall consumer debt. The article listed above mentions how the appliance market has suffered because people have been choosing to fix their appliances rather than buy new. GREAT! That’s responsible behavior. It’s not a problem to be solved by the government. If industries such as appliance and car makers are suffering, they need to adapt their approach, re-tool their businesses, and look for ways to innovate. They shouldn’t rely on the government to bail them out. The whole thing frankly gets me riled up.

Now I’m no economist and can’t eloquently argue the virtues and vices of Keynesian government spending programs. Maybe they’ll have an overall positive impact. But my gut tells me they are wrong simply because they encourage lazy behavior. They don’t encourage personal accountability which is what got us into this economic mess in the first place. Citizens will eventually have to pay for these government programs in the form of increased taxes, which will be harder to pay with their added debt from appliances and cars.

I guess we’ll find out soon what the details are of this newest program so stay tuned. If you are in the market for a new appliance, by all means try and take advantage of this program. If you’re not, be happy with what you have and please don’t go into debt just to take advantage of a measly little discount.

Am I way off on this? Please leave a comment and let me know what you think. I actually would love to hear some good reasoning as to why the program is a good thing so I can at least feel a little good about it. Will energy-efficient appliances really save the environment that much? Will this really help the economy turn around?

Tags: appliances, cash for clunkers, economy, government

Posted in Debt, News | Comments Off on Cash for Refrigerators

Credit card companies adjust limits: credit ratings may be affected

Written by Sam on August 21, 2009 – 2:28 pm -A new study by Fair Isaac, the company that created the FICO score, shows that the credit ratings of 24 million borrowers decreased on an average of 20 points after credit card issuers lowered ratings late last year. The frustrating things about this study is that the rating decrease wasn’t due to late payments or any misbehavior on the part of the borrower. Instead, the ratings changes because the utilization ratio increased for the borrowers whose rates were decreased. The utilization ratio is simply a measure of how much money has been borrowed compared to available lines of credit. In general, the higher this ratio, or the more people borrow compared to how much they could borrow, the lower your rating.

If you’re looking to borrow for a home or car, you may want to check your current score by checking the credit reports that you can get for free. A 20 point drop is enough that you may not qualify for the same rates as you could before.

Read more about this study at USA Today.

Download your free credit reports here.

Tags: Credit Cards, credit rating, credit report

Posted in Credit Cards, Credit Ratings | 1 Comment »

A more effective way to manage your personal finances (lead vs. lag indicators)

Written by Sam on August 18, 2009 – 12:18 pm -A while back I attended a FranklinCovery “4 Disciplines of Execution” workshop for my work. It’s a brand new training course and our company, being located in Utah close to FranklinCovey, was chosen as a test group. They brought up some very interesting points about the most important measures for determining success in reaching your goals. As I went through the training I could help think how these concepts apply to personal finances.

Lead vs. Lag indicators

One of the major distinctions they made in the training was between lead and lag indicators. These are measurements you can track that help you achieve your goals. A lead indicator is something that can be tracked and acted upon in the moment and that predicts the outcome. A lag indicator is something that can only be tracked after a result has been achieved. Lag indicators don’t predict an outcome, but rather show the results of an outcome that has already occurred.

The main point here is that a lead indicator is also something you can control in the moment whereas a lag measure is something you can’t control because it’s already happened.

Lead vs. Lag example

Confusing? Here’s an example. Let’s say your son has a goal to save $5 for a toy at the end of the month. In this situation a lag indicator would be how much he saved last month. It already happened and can’t be changed. It also won’t predict how much he’s going to save this month. In other words, it can’t be acted upon. On the other hand a lead indicator could be how much he puts in his piggy bank every day. This is a measurable indicator that your son can influence and act upon and will predict how much he has saved at the end of the month.

As you can see from this example, it’s important for us to identify the lead indicators for reaching a goal because they help us act and to achieve the goal.

Applying lead and lag indicators to personal finance

So how does this apply to personal finance? I often see people using lag indicators to try and predict future performance within their finances. For example, how many of you have wanted to figure out what you are going to spend next month on groceries by looking at expenses from last month? We’ve all done it and yet that is a lag measure. How much you spent last month may have nothing to do with the expenses you’ll incur next month. Further, you can’t act to change what you spent last month. Looking at your finances this way is almost useless in helping you curb future behavior.

Instead, what are some lead measures that could help you predict next month’s grocery spending? What measures will help you achieve a goal of spending a certain amount and no more? There actually could be many different lead measures, but let me suggest a few possibilities.

Lead measure examples

One lead measure could be how many times you go to the store every week. By going to the grocery store less you may spend less which would help predict how much you’ll spend by the end of the month. This probably wouldn’t be the most effective lead indicator, but it’s a start.

Another, slightly better lead measure could be creating a spending plan for your groceries. By outlining how much you’re going to spend on what, you can predict what the total expense will be and such a plan will influence your behavior. While this is a much more effective lead measure and will be more highly predictive of the final outcome, it would require a lot of time and work.

Probably my favorite lead indicator for how much you’ll spend on groceries next month is how much cash you take out to spend on groceries. Of course, this assumes you are exclusively on a cash basis for groceries and that you wouldn’t purchase groceries on a credit card. If you take out $400 for groceries and only spend that cash, you have a perfect lead measure that predicts you will spend $400. Cash serves as the perfect feedback loop. Once the cash is gone, it’s gone. Cash is also a great lead indicator because it can influence your behavior in the moment. If the cash is running low, you may reconsider purchases or decide to purchase some items next month if you don’t really need them yet.

Don’t be deceived by “quick lags”

In contrast, let’s look at using credit cards to measure spending. Many people would consider using credit cards to be a lead indicator because they can look up their account at any time and see what they’ve spent. However, using a credit card in this manner is NOT a lead indicator. Instead it’s what they call a “quick lag.” A quick lag is something that can seem like a lead indicator, but has already occurred and can’t be influenced.

The best comparison is someone trying to lose weight. It may seem like weighing yourself daily is a lead indicator, but it’s actually a “quick lag.” Why? When you weigh yourself, you can’t immediately change the results. There is nothing actionable about weighing yourself. Your weight is the result of decisions you’ve already made and can no longer control.

Looking at your credit card spending at the end of every day is the same way. You can’t go back and change what you spent. Your spending is a lag indicator showing what has already happened and it can no longer be acted upon.

Now I will agree that if someone were to look up their account before every purchase to see how much they’d spent in a certain budget category, it could be a lead measure and could influence behavior in the moment. But that is not a common behavior nor is someone likely to go through the hassle of doing so.

How to create your own lead indicators

So how do you create your own lead indicators to help you reach your financial goals? There’s no one clear answer to this question. Identifying lead indicators can take some creativity and can be a fun process. Here are some guidelines that will help.

Characteristics of lead indicators include the following:

- they are forward-looking and predict future performance

- they predict or contribute directly to achieving a goal

- they can be influenced or changed in the given moment

Characteristics of lag indicators include the following:

- they are backword-looking and measure something that has already occurred

- they can not be changed or influenced

Try looking at the measures you use to control your finances and see if they are lag or lead indicators. Can you change or improve them to be more effective? What behaviors or actions are predictive of how much you spend? How much you save? By re-evaluating your system within the framework of lead and lag indicators, you may have some useful insights that will help you achieve your goals more quickly and easily.

What measurements do you use? Leave a comment and share what measures have worked best for you.

Tags: Finances

Posted in Finances, Personal Finance | 1 Comment »

10 Truths About Timeshares

Written by Sam on August 14, 2009 – 2:08 pm - Like many of you, we are always looking for a good deal. So when we recieved an offer for 2 nights in a king-bedroom suite for only $69 at a local resort, we took it. In addition, we would receive a $100 gift card good for shopping or fine dining–all we had to do was go to a 90-minute tour and presentation. By my calculations, they were going to pay us $31 for a fun weekend getaway.

Like many of you, we are always looking for a good deal. So when we recieved an offer for 2 nights in a king-bedroom suite for only $69 at a local resort, we took it. In addition, we would receive a $100 gift card good for shopping or fine dining–all we had to do was go to a 90-minute tour and presentation. By my calculations, they were going to pay us $31 for a fun weekend getaway.

Anyone who has attended a timeshare presentation is laughing out loud right now. Because once you’ve been through it, you know the reality is far from the marketing pitch.

Truth #1: 90 minutes takes longer than an hour and a half. In our case it was three hours–and I suspect it would have been longer if the sales rep thought he had any chance of getting us to buy. If you ever choose to hear a timeshare sales pitch, expect to sit for double the time. You also may want to practice your get-up-and-walk-out-of-the-room-while-someone-else-is-talking skills. These sales reps are well prepared to talk around any objection, even “I’m not interested and will not buy.” Getting up and rudely walking out may be your only way out other than being at their mercy for an undetermined amount of time.

Truth #2: A timeshare will not save you money. The first thing our sales rep did was determine how much we spend on hotels per year. We estimated six nights at $100 each, for a total of $600. Multiply that by twenty years, and we will have spent at least $12,000 on hotel accommodations. For that same price we could own a week of timeshare! Sounds good…except for the fact that the yearly maintenance fees alone cost $800, 30% more than we spend right now. And that doesn’t include payments on the property. Not nearly the savings he was trying to make us believe we would get.

It was curious that the price of the timeshare was exactly what we would spend on hotels over 20 years. I wonder what would have happened if we had said we spend $1,000 a year. Would the price have gone up to $20,000 for the timeshare?

Truth #3: You will see a lot of numbers, but not the ones that matter. They gave us a lot of numbers–a white board full of figures floating around. But none really helped us determine if we can afford it. When we asked the sales rep for specifics on costs and fees we were told he would lose his job for disclosing such information. We were told that AFTER we signed we would receive an owners manual with all the details. So we had no way to determine the real cost until it was too late. ARE YOU KIDDING ME?

After the fact, I came home and jotted down the basic figures we were given. Assuming the numbers he gave me were real and not unrealistically low, I determined that the monthly cost of a timeshare would be at least $225; that’s compared that to the equivalent of $50 a month we spend now!

Truth #4: They want you to finance your “purchase” because it makes the timeshare company more money. The company offered tons of perks and rewards for each year you finance the timeshare through them. Not a surprise since they charge 14.5% interest! Check out these numbers:

- Price: $12,000

- Downpayment: $2000

- Closing costs: $500

- Balance to be financed at 14.5%: $10,000

- Interest paid over the course of the loan: $8993.60

- Principle and interest paid over the course of the loan: $20,993.60

The total cost, including downpayment, closing costs, principle, interest and maintenance fees for 20 years, is $37,494.60.

In the end, you would pay 75% more to finance through them. No wonder they offer perks!

Truth #5: You are investing in vacations, not real estate. Our sales rep kept explaining that we are investing in real estate. True, timeshares sell you a piece of property during a certain period of time each year. You do get some sort of deed for the property. But the real estate comparison ends there. If the value of a timeshare will increase over time and is in such demand, why is it so difficult and expensive to sell a timeshare? As I looked for information online, there was twice as much information on selling timeshares than on buying timeshares.

Truth #6: You are signing up for a one-on-one (or one-on-two, if married) high-pressure sales pitch, not a lovely tour of the property.. When we entered the sales offices, we were impressed by the lavish decor and saw beautiful glassed-in rooms where people were watching sales videos. We also saw sales reps touring people around the property. “That won’t be so bad,” I thought. Well, it turns out the videos and tours must be for people who’ve already purchased or expressed interest in purchasing. In our case they put us in a small office for the entire three hours with no discussion of the resort facilities or amenities. We were exposed to a high-pressure pitch from a sales rep who wouldn’t take no for an answer. It was excruciatingly painful, and I frankly felt a little violated. For an idea of what the experience was like, check out this article about what a timeshare presentation is like and how to avoid pitfalls.

Truth #7 Timeshare presentations are about buying, not about learning. Don’t make the mistake of thinking you can go to a presentation to become informed. You must go prepared to buy, or not buy. Timeshare companies offer incentives that are only good RIGHT NOW, TODAY; tomorrow is too late. You cannot have a night to sleep on it, you cannot consult your accountant or lawyer. Tell me, who makes real estate purchases for tens of thousands of dollars in such a way?! To learn about timeshares, you might want to read a book, like Surviving a Timeshare Presentation, or Timeshare Vacations for Dummies by Lisa Ann Schreier, a former timeshare sales rep who offers an “insider” look.

Truth #8 Timeshare sales reps are friendly, but they are not your friend. And the friendliness only lasts until it’s clear you’re not going to buy. The way our sales rep framed things, buying a timeshare seemed to make so much sense; it was in our best interest; our sales rep was only trying to help us make a sound financial investment. Don’t be fooled! These are highly trained professionals and they are only trying to help themselves out with a nice commission on a sale. All his friendliness abruptly ended towards the end of the three hours when it became clear we wouldn’t purchase TODAY. In fact, it was odd because we expressed interest in the timeshare and said we would consider it, but wanted to have more time. I would think a good sales rep would take our information and follow up in few days. Instead there was no interest in following up; it was as though he knew the deal would crumble under scrutiny.

For an inside look, read sales tips that timeshare sales reps share to help each other out. In this article, entitled Timeshare sales techniques-Warm up the author says that the first step is to make friends with your clients. There’s also an entire blog dedicated to the subject or timeshare sales techniques.

Truth #9 A timeshare will always cost you money, not make you money. Even once you finish making payments on a timeshare, you still have to pay maintenance fees, whether or not you use the timeshare. They explain that one of the great benefits is that you own it forever, and can pass it along to your children. Ironically, it seems that some children don’t want the financial burden that comes with a timeshare. In fact, I found a company called Timeshare Relief that specializes in taking over timeshares – ones that are paid in full – to relieve the owners of the financial responsibility. Among the testimonials is a video testimonial of some “satisfied clients who realized Timeshare Relief was their only answer to receive financial freedom and escape their a life long burden of their Timeshare.”

Truth #10 A timeshare might be a great choice for your family. I won’t argue that timeshares may be a great decision for some people. But making a decision about purchasing a timeshare is not one you want to make while on vacation, under pressure, with no time to think about or discuss it. The package we were offered seemed like it might be a good fit for us–in about three to five years. Right now we take a lot of smaller vacations; long weekends instead of week-long trips. Also, we don’t have an extra $200 per month to dedicate to travel (which does not include the extra gas, airfare, food, and excursion costs). When we are ready and a timeshare makes sense, we will do a lot of research, and then make a purchase if it makes financial sense.

There’s really no reason to make a timeshare purchase decision under pressure. There are plenty of companies that specialize in re-selling time shares. Not only can you purchase them for a fraction of what you’d pay in a high-pressure sales pitch, but you can have the time to browse and find the deal that best meets your needs. I have relatives who have purchased a few timeshares. The first one they purchased under pressure at a sales pitch. Within a couple of days, they saw an ad for a timeshare re-seller and were able to find the exact same timeshare at about half the price. Luckily, they were able to cancel their original purchase and take advantage of the lower-priced offer.

In summary, I won’t say if it’s worth it to take advantage of these great timeshare offers or not. For me personally, having to sit for three hours in a high-pressure situation, wasn’t worth the essentially-free nights stay. On the other hand, I know people who don’t mind going through the process and they will take advantage of such offers regularly. If you know the pitfalls to avoid, more power to you. For me, after sitting for three hours and considering the possibility of spending nearly $40,000 on a timeshare over the next 20 years, a piece of Japanese wisdom rings true: There is nothing as expensive as free.

Resources:

- 7 Timeshare Tips Every Consumer Should Know

- Timeshare Tips (includes FTC article on buying timeshares)

- Is Time-Sharing Ready for Prime Time? and Time-share Tips by Business Week

- Timeshare Buying Tips

- 7 Tips for Buying a Timeshare

Tags: Real Estate, timeshares, vacations

Posted in Investing, Real Estate | 1 Comment »

Affordable Hobbies: An Introduction to Geocaching

Written by Sam on August 11, 2009 – 8:30 am - Given the tight economy it’s more important than ever to keep control over your finances. In our family, we’ve had to cut back on entertainment expenses. Now instead of paying a babysitter, we trade off babysitting with a neighbor. We’ve stopped eating out very much, and try to eat at home. It’s been a while since we’ve been to the movie theater and usually opt to rent a $1 Red Box movie instead.

Given the tight economy it’s more important than ever to keep control over your finances. In our family, we’ve had to cut back on entertainment expenses. Now instead of paying a babysitter, we trade off babysitting with a neighbor. We’ve stopped eating out very much, and try to eat at home. It’s been a while since we’ve been to the movie theater and usually opt to rent a $1 Red Box movie instead.

Cutting back has also affected how we spend money on our hobbies. Ok, I’ll be truthful; it’s cut back on how much I spend on hobbies. For example, I used to fly remote-control airplanes which is not a cheap hobby. With each outing I ended up spending $20-40 on parts after the plane crashed. To get started alone can run from $150 to upwards of $1,000. Needless to say I haven’t flown lately.

Instead, I’ve found myself spending time on hobbies that are much more affordable. One such hobby is Geocaching.

What is Geocaching?

Pronounced jee-oh-kashing, Geocaching is like a modern-day treasure hunt. Someone hides a container, known as a “cache” (pronounced “cash”), anywhere in the world and then records the location using a GPS (Global Positioning Satellite) unit. He then logs in to the website Geocaching.com and uploads the coordinates. He can add a description of the cache and location or even add a theme or a quiz to the cache to make it more interesting.

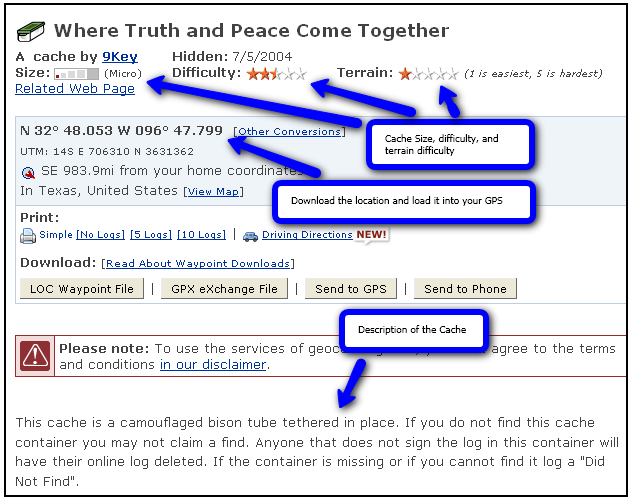

Here’s an example of what a typical cache might look like on geocaching.com:

Once the cache is placed and the coordinates are uploaded, anyone can go to the geocaching.com website and search for caches they can find in their geographic area.

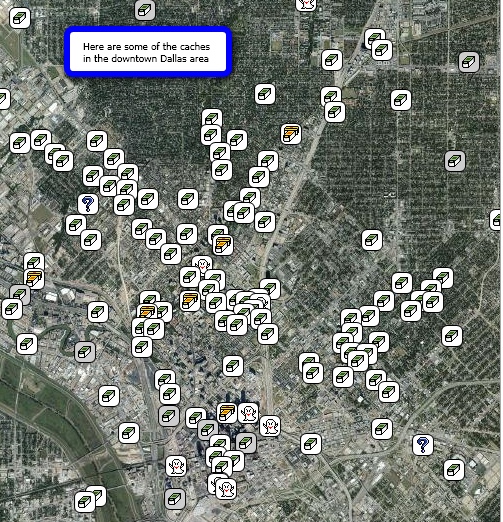

Below is a screenshot of caches found in the downtown Dallas TX area:

Once you identify the caches you want to find, you can load the coordinates and description of the cache into your GPS unit or gps-enabled phone and set off on an adventure to find the cache.

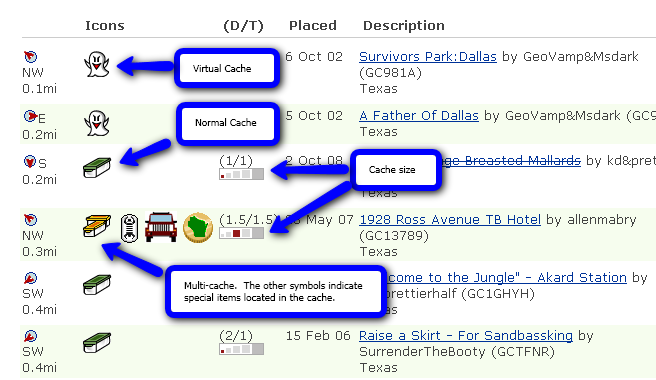

The image below shows the results of a search for caches in the Dallas Texas area:

Once you find the cache you write your name in a log book located in the cache itself. If the cache container is large enough, there are typically a few trinkets placed inside as well. Geocaching etiquette dictates that you can take something from the cache as long as you leave something. It’s great for kids because it’s literally a modern-day treasure hunt. You never know what you’re going to find. When you get home after finding the cache you can then login to geocaching.com and record your find, thereby keeping track of your exploits. I personally have logged over 50 entries and I’m a novice. The more active participants have logged hundreds of finds.

Where can you participate in geocaching?

Although geocaching is still relatively obscure, I’ve been amazed at how many caches there are. Go ahead and test it yourself right now by entering your zip code at Geocaching.com and see how many results appear. Once the results appear, click on the “map it” link in the upper right hand side of the screen to see a map view of the caches. I’d bet that there are several caches within a couple miles of your home. In fact, there are possibly tens or hundreds within your city boundaries.

While populated areas often have hundreds of caches, it’s also common to find them in the wilderness. In fact, this is where more of the large-sized caches are found. Many people use geocaching as an excuse to exercise and get out in nature.

What types of caches are there? What are they like?

The cache containers range from extremely small (the size of a thimble or even smaller) to very large (the largest I’ve seen was an average-sized cooler). It’s common to see containers in the form of Altoids tins, small medicine bottles, ammo boxes, and Tupperware containers. Really small caches are known as “micro-caches” and can be located in even the most crowded urban areas without being noticed.

The image below-left shows an ammo box cache. Below right shows a tupperware cache:

There are also caches known as “virtual” caches where there’s no physical container. Instead you have to locate a landmark of some sort. It’s common for virtual caches to lead you to a historical marker or location.

My favorite caches are “multi-caches” which consist of a series of caches that each give you a clue leading to the final cache. It’s like trying to solve a mystery or puzzle and can take several outings.

Who typically participates in geocaching?

There’s a pretty broad range of people who geocache including scouting groups, retirees who find it a good form of exercise, and families. I had a business colleague who would take his GPS unit on business trips and use geocaching as a way to familiarize himself with the area and its history. During one business meeting, the client was impressed with his knowledge of the area.

How much does it cost to get started?

The great thing is that you can get started geocaching for relatively cheap if not free. Many new smart phones have GPS functionality built in along with programs to map your position. In this case, no purchase is necessary. Otherwise, you’ll have to purchase a GPS unit. GPS units range in cost from around $50 to several hundred dollars. Last week I saw a very good GPS unit with mapping capabilities on sale for $100. While even the cheapest units will work, I recommend getting a unit with mapping capabilities. All but some of the cheapest units have maps built in.

Once you have a GPS-enabled unit, you can go to geocaching.com and start searching for caches and logging your finds for free. Geocaching.com offers a subscription service for $30 a year or $10 a quarter that allows some advanced features such downloading multiple caches at once and sending automatic emails containing new caches in your area. I currently subscribe to the service and find it very useful.

There is also software you can download to some smart phones that integrates with geocaching.com to instantly show nearby caches and with the built-in GPS functionality to show you the way. I used a trial version of the software on my Blackberry and found it very useful for impromptu caches when I felt the itch or had some spare time while traveling. On my particular phone I didn’t find the GPS to be quite as accurate as my stand alone unit, but the convenience made up for weaker accuracy. For some caches, I also found myself getting a little dirty and didn’t want to expose my phone to the elements. In such cases a stand-alone GPS unit may be better since they’re rugged and typically water-resistant. I recently checked out the geocaching website and saw that they have a new iPhone app. I must admit I was drooling over the satellite map integration and large interface. It looks like a very worthy iPhone application.

Making memories

One of the best things about Geocaching is building memories with others. I have vivid memories of the adventures I’ve been on while Geocaching with others. I’ve been with my son, friends, in-laws, and cousins. One particularly tricky multi-cache adventure took me and my brother-in-law from one side of Las Vegas to another. We probably covered 150 miles in one night. By the time we got to the last cache it was dark and we were in the middle of the desert trying to find the cache by flashlight. After about a 40 minute search, we finally found it. Good times.

If you’ve tried Geocaching, leave a comment and tell us a story from your own adventures.

Posted in Entertainment, Hobbies, Saving | 3 Comments »

Subscribe via email

Subscribe via email  Become a fan

Become a fan Subscribe via RSS

Subscribe via RSS Follow me

Follow me