How Your Credit Score Is Calculated

Written by SamThere’s been a lot of talk in the news lately about credit card companies making changes, such as lowering credit lines and cancelling unused cards, that can lower credit scores even for responsible borrowers. In a recent post How to save your credit score I complained that credit scores seem to be such a mystical thing. I almost always hear broad generalities about how to improve your score, but rarely hear specifics.

Today that changed.

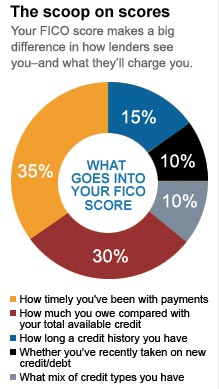

An article from CNNMoney.com (via Yahoo!) helped to clear up some of the confusion. The article actually breaks down how a credit score is calculated. Here’s a graph from the article:

It wasn’t clear to me if this graph covers ALL the factors in calculating a credit score, but it probably represents the most important factors. One clarification CNNMoney makes is that you should keep your debt utilization ratio under 10% if possible. It should never go higher than 20%.

I encourage you to read the whole article, but here is a summary of the most important factors in how your credit score is calculated and what you should do to keep your score healthy.

- Don’t make late payments (specifically over 30 days late).

- Keep your debt utilization ratio at ideally under 10% and certainly no more than 20%. This applies to any given credit account as well as looking at your debt for all accounts.

- Try to occaisionally use older credit cards so they don’t close the account on you. Older credit carries a greater positive weight in calculating your score.

- Opening new credit accounts tends to lower your score. Still no specifics on how much it lowers your score.

- The type of credit account you open has an affect on your score. While the CNNMoney article didn’t mention specifics, we know from my previous post that you should try to avoid opening accounts for retail and gas credit cards.

The article also listed a couple of resources that I haven’t had a chance to thoroughly check out, but that look useful.

Card Ratings.com

CreditKarma.com

Tags: credit rating, Credit Score, FICO

Posted in Credit Cards, Credit Ratings, Credit Score | Comments Off on How Your Credit Score Is Calculated

Subscribe via email

Subscribe via email  Become a fan

Become a fan Subscribe via RSS

Subscribe via RSS Follow me

Follow me